Discover why cash flow is the secret to sustainable business growth, and how to make sure you don’t let it slip.

Your business is up and running, customers are raving about it and the press coverage is rolling in. But before posting a New Year's celebratory tweet and cracking open that bottle of bubbly, read on to discover why cash flow is the secret to sustainable business growth, and how to make sure you don’t let it slip.

A whopping 8 out of 10 entrepreneurs that start businesses fail within the first 18 months of trading, according to research by Bloomberg and insurer Hiscox. You might guess it's because their idea is weak or they don't put the hours in, but the number one reason is cash flow.

Cash flow is the net amount of cash and cash-equivalents being transferred into and out of a business.

Investopedia

Entrepreneurs that fail to calculate how much it costs to not only start a business but also keep it going will hit a brick wall. Start-ups can easily take two years or more to become profitable – household name Uber still isn't profitable after 10 years – and in the meantime, bills need to be paid. Rent, salaries, tax, inventory, invoices, marketing – the list goes on.

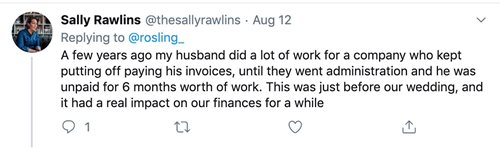

When journalist Liz Rosling put a shout-out on Twitter for business owners that had experienced cash flow problems, she was inundated with replies. "Devastating", "almost put me under several times" and "lost a fortune in sales" were just some of the tweets from exasperated entrepreneurs.

Tweet from Sally Rawlins, photographer in Essex

Figure out your cash flow

You know you have a problem when more money is going out than coming in, so keep a good record of your business' expenses and revenues to spot any potential problems before they manifest. You can do this using a simple template such as Google Docs, or try dedicated software like QuickBooks to forecast your future cash flow. Download an expenses and receipts tracker app to take pictures of receipts and upload them to your account before losing them down the back of the sofa.

What if you find yourself short on funds? The three likely reasons for running into cash flow problems are invoices not getting paid, surplus stock and bad management, according to insolvency practitioner, Real Business Rescue. The biggest bugbear for small businesses is unpaid invoices, which the government’s Small Business Commissioner has vowed to crack down on. Read the advice here.

On average, it takes 72 days to get an invoice paid. Source

American Express

If you have no luck chasing payment, consider invoice financing. GapCap, formerly based at Workspace's The Record Hall in Hatton Garden, is one of many companies that will pay you the invoice amount upfront, in return for a fee. Leave the invoice chasing to the professionals and carry on with your main purpose: running and growing your business.

Make the most of free advice

Once your business can meet its daily needs, think about how you will finance it for the future, especially if it is yet to be profitable. There's no such thing as a free lunch but there is plenty of free advice from resources like Informed Funding, which independently connects businesses with finance and funding.

Credit cards, savings, bank loans, microloans, overdrafts, crowdfunding, debt and equity financing, P2P lending, invoice financing – the options are endless. Start with a free, one-hour consultation with Informed Funding at a Workspace centre or over the phone. You can get advice on:

- Sourcing the right type of finance for your business

- Understanding the hidden costs of tools like invoice financing

- Common mistakes like giving away too much equity too cheaply

However long your business has traded for, make sure your finances are up to speed by sorting out the daily cash flow and engineering financing to take your business to the next level.

Further information

Book your free one-hour Informed Funding consultation on Eventbrite. Between January and March 2020, they will be held at Metal Box Factory in Southwark, Grand Union Studios in Ladbroke Grove, The Leather Market in London Bridge, Kennington Park in Oval and The Frames in Shoreditch.

Flick to page 22 of homeWORK magazine to find out why London is the best place to finance your fledgling business, and look out for the next blog in the Scale-Up Series about finding the right space to grow your business.

You can also check out Innovate UK for government funding for projects of all shapes and sizes like food production, power electronics, decarbonisation, aerospace research and more.